By Kate Wittels, Giacomo Bagarella, Bret Collazzi, and Amelia Taylor-Hochberg

Innovation happens constantly, some of it directed at cities. Not all of that urban community-directed technology is actually good for the people who live in cities. That’s why we see collaboration as essential to creating technology for good — going beyond the collaboration among innovators that is routinely celebrated to effect collaboration with and led by tech users, civic stakeholders, and communities themselves. Our clients have demonstrated that collaboratively developed tech products can redress economic, environmental, and social challenges and contribute to local strength and resiliency.

1. Collaboration with users is fundamental to building public service tools that are accessible, useful, and effective.

When millions lost their jobs in early 2020 due to the impact of COVID-19, the federal government expanded eligibility for unemployment insurance, enabling gig workers to apply for benefits for the first time. However, state agencies weren’t prepared to process their applications, leading to months-long delays, inaccurate benefit payouts, and vulnerability to fraud.

The Workers Lab (TWL), a nonprofit based in Oakland, CA, that is committed to developing ideas that increase worker power, partnered with Steady, a mission-driven consumer technology company to develop a tool that would enable gig workers to report their incomes more easily and states to deliver accurate benefits faster. HR&A supported TWL by serving as the project manager and strategic advisor for the pilot of the tool — TWL’s Design Sprint for Unemployment Insurance.

(Image Courtesy of The Workers Lab | TWL Benefits for Gig Workers Part 1)

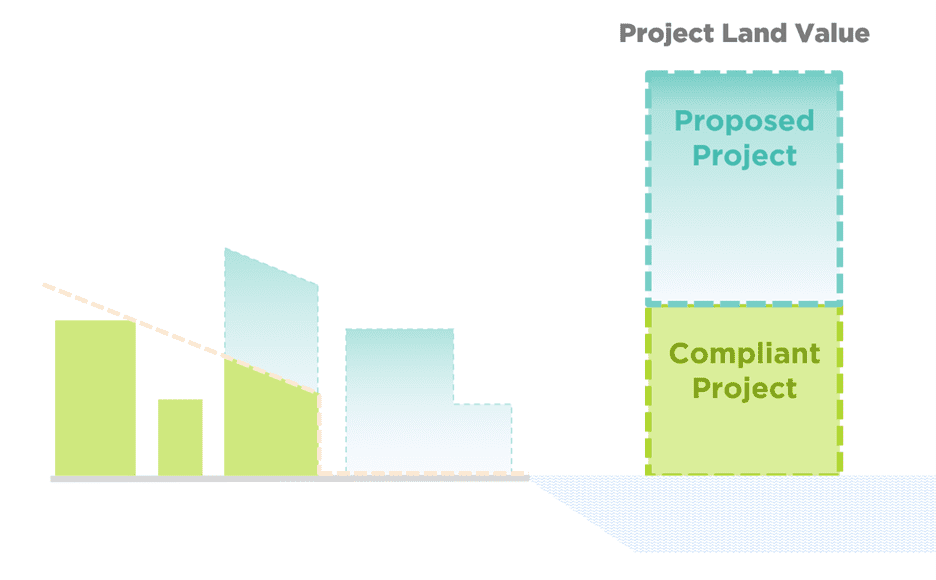

In our first phase of work, we focused on partnering directly with gig workers to design the tool to reflect their experience and needs. The resulting browser-based tool enabled gig workers to draw proof of their earnings directly from their gig platforms and financial accounts, and produce a simple, legible income report for use in unemployment applications.

We then piloted the tool in a real workflow, assisting state departments of labor in Alabama and Louisiana to process their backlog of thousands of unemployment benefit applications. In Alabama, the tool was able to automatically process 35% of claims as eligible, helping clear issues before a state staffer even had to look at the application — reducing staff review time from 15–60 minutes per claim to as few as 1–2. The tool also deters fraud, as it requires being linked to a person’s financial accounts and reporting that connection to the state. An Alabama Department of Labor staffer told us, “If we could’ve had [this at the beginning of the pandemic], that would have been excellent. It would have expedited some of the backlog.” In Louisiana, after receiving an application with a Steady income report, the state could approve the claim and pay the worker in less than 24 hours — far faster than the three weeks that the manual approach required.

The Workers Lab was invited to testify in front of the U.S. House Congressional Subcommittee on Government Operations in March 2022 and delivered a strong endorsement of worker innovation.

As more states seek to automate verification of income from gig work across public benefit programs (including the Supplemental Nutrition Assistance Program, Medicaid, and more), pilots like this Design Sprint can serve as a proof of concept for how partnerships between tech and government can help meet intense demands during crises and improve policy for the future.

2. Platforms that support urban tech entrepreneurs are critical to scaling solutions that address pressing civic issues.

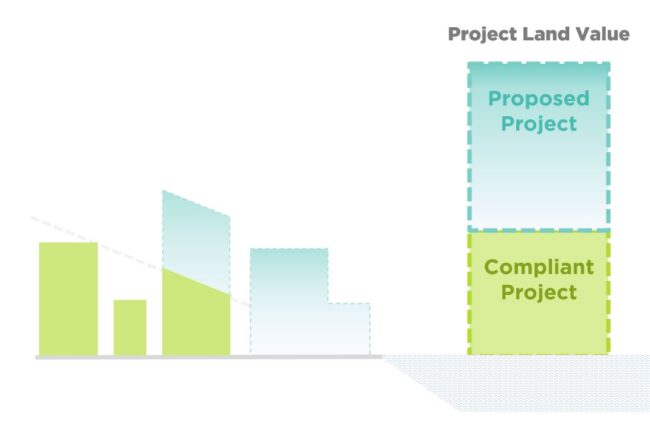

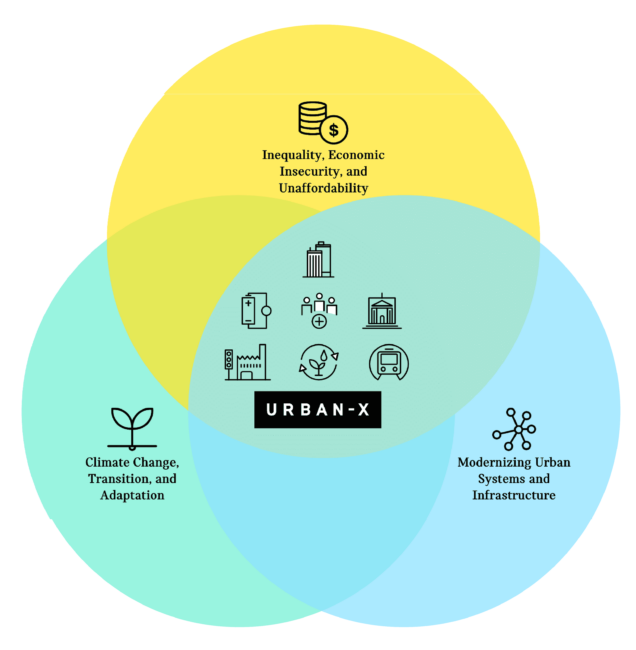

URBAN-X is a venture accelerator founded by the iconic carmaker MINI in 2016. It supports urban tech startups in developing, bringing to market, and scaling solutions across three major challenges: climate change, obsolescent urban systems, and inequality. URBAN-X leverages in-house talent and external expertise to provide guidance and mentorship in design, engineering, business strategy, sales, marketing, product development, and fundraising. HR&A, supported by Autocase Economic Advisory, evaluated how URBAN-X helps startups scale and generate economic and social impacts, promote entrepreneurial diversity by gender and race, and reduce environmental harms.

(Image Courtesy of URBAN-X)

Many urban tech founders credit their success in advancing innovative solutions to their participation in URBAN-X. Of the $6.1M in funding that each alumnus has raised on average, $5.7M was raised during and after participating in the program. In addition, every job created at an URBAN-X company supports the creation of 1.5 additional jobs, with an average compensation of $100,000.

A sample of achievements by URBAN-X’s alumni includes:

- Circuit, which provides access to on-demand, free or low-cost electric shuttles in dense areas, helps cities reduce congestion, enhance mobility options, and lower emissions. In four years, the company has avoided the emission of 19,000 metric tons of CO2 and reduced the cost of congestion by $16M.

- Farmshelf, which creates smart, indoor, bookshelf-like farms that allow anyone to grow their own food, avoids 30,000 metric tons of waste annually by growing food where it’s consumed.

- Gradient, an in-home, residential cooling and heating system that is easy to install and lowers carbon emissions, is currently partnering with the State of California to provide units to low-and moderate-income households that otherwise might not be able to afford such solutions.

URBAN-X has begun to share its impact and lessons learned, leading the way in accelerating innovation by the next generation of urban entrepreneurs.

3. To ensure that innovation economies serve everyone, builders of technology ecosystems must proactively engage affected communities and commit to investments that benefit all.

Houston’s workforce is a national leader when it comes to the Black and Latinx share of the tech ecosystem, but progress is still needed to reach equitable representation. Houston has the third-highest concentration of STEM workers in the country, but Black and Latinx workers make up only 36% of the tech ecosystem despite being 58% of Houston’s overall workforce – a mismatch that also occurs nationally, with participation in the tech ecosystem at 15% versus being 23% of the overall workforce.1 HR&A’s work with the Rice Management Company (RMC) seeks to move this needle through the Ion District innovation campus. The District’s anchor, the Ion, is a quarter-million square foot development that provides offices for tenants like Microsoft and Chevron Technology Ventures, shared workspaces, makerspaces, event venues, classrooms, and a host of other amenities. These resources offer a platform for growth and collaboration among entrepreneurs, incubators, accelerators, corporations, academics, and others in the Houston community.

Launching the Ion involved establishing a Community Benefits Agreement (CBA) between RMC and the City of Houston. The CBA, which sets a national standard for such agreements, was the result of a two-year community engagement process that brought together stakeholders from neighborhoods adjacent to the Ion, business, and civic leaders to identify and address community desires. Concerns around displacement and gentrification were top of mind, resulting in a CBA that dedicates $15.3 million in direct investments and community partnerships that provide tech sector job training and placement, an accelerator and innovation programs — including a venture fund — for women- and minority-led ventures, support for affordable housing, and social services to address homelessness. RMC has also committed to provide real estate investment opportunities for minority residents and minority- and women-owned businesses so that the District can facilitate building local wealth.

* * *

We’re proud to have worked with a diverse set of partners committed to applying these principles and ensuring that cities are the source of solutions to our most pressing issues.