Sign up for our newsletter here!

Much more is on the ballot on Tuesday than the White House, Congress, and hundreds of State Houses and City Halls. Local ballot measures may unlock billions of dollars in new spending authority, change the powers of local governments, and shape a more just and resilient recovery – or not.

We’ve worked with our team of experts and collaborators to highlight more than 50 of these measures across 8 issue areas – it’s #UrbanismOnTheBallot

AFFORDABLE HOUSING

Will cities’ role in housing continue to expand?

As growing cities face a housing affordability crisis, voters will weigh in on dedicating additional local funds for affordable housing and expanding and strengthening rent regulations. The majority of these referenda are products of long-running campaigns to increase the role of local governments in addressing affordable housing. These votes will be a good indication of whether voters continue to view affordable housing as a pressing issue – a budget priority. – HR&A Partner Phillip Kash

- Voters in Raleigh, N.C. are deciding on the City’s largest-ever affordable housing bond. Portions of the $80 million raised would be used for public-private partnerships, gap financing, and purchasing land for affordable housing along new transit lines. $50 million in bonds on the ballot in Charlotte could increase the supply of affordable housing in North Carolina’s largest city, too.

- In Detroit, City government is seeking permission to issue $250 million in bonds to rehab 8,000 homes and demolish an additional 8,000 homes that contribute to blight. HR&A is helping the city develop the programs that would enable Detroiters to access affordable housing and make neighborhood improvements through this program.

- Californians will consider lifting limitations on local rent controls once again. On the other side of the country, Portland, Maine could limit rent increases to the rate of inflation and restrict short-term-rentals to owner-occupied properties.

- Coloradans could embrace new taxes to stem the tide of homelessness. In Denver, increasing the sales tax by 0.25% would mean an additional 1,800 units of supportive housing. In Boulder, a $75 annual fee per unit on landlords could mean $1.9 million to provide legal representation to tenants facing eviction.

- Nonprofits could get a boost in Georgia. Statewide, voters could exempt nonprofits from taxes on properties they are using to build or repair single-family homes for affordable housing. In Atlanta, voters could exempt homes located on community land trusts from $30,000 in property taxes.

↑ Back to Top

TRANSIT

Will cities build back better with transit?

In the face of devastating and disparate impacts of the COVID-19 pandemic, transit investment remains critical to the well-being of our communities. Ballot initiatives across the country seek new funding to invest in diverse mobility options – including rail, bus, walking, and cycling - in support of a just and resilient recovery. In Austin and Portland, equitable access, affordable housing, and anti-displacement measures are incorporated into mobility proposals. And as core suburban areas like Georgia’s Gwinnett County seek to strengthen their position as centers for knowledge economy jobs, they are increasingly finding that high-quality transit connectivity within the metropolitan region is essential to their competitiveness. – HR&A CEO Eric Rothman

- Propositions in the Austin, TX, and Portland, OR metros would fund improved transit connections and diverse mobility options with equity in mind. Austin Prop A, a property tax increase of approximately 4% would fund a $7.1 billion mass transit system and some 27 miles of rail service while earmarking $300 million for anti-displacement measures and affordable housing along the TOD routes. Austin Prop B includes infrastructure like sidewalks, bikeways, and transportation safety projects, and is viewed as a climate change prevention and transportation measure. Portland’s Measure 26-218 would fund ~150 transit projects in 17 regional corridors through proposed projects including light rail, rapid regional bus, and off-street biking and pedestrian improvements.

- In Gwinnett County, GA, the expansion of the Metropolitan Atlanta Rapid Transit Authority (MARTA) through a 1% sales tax is up for vote. Voters have rejected joining MARTA in the past; this latest proposition promises local control, with County residents sensitive to the idea that funding would be used for MARTA operations elsewhere in the region.

- In the Bay Area, voters could authorize a measure to increase the sales tax by 1/8 cent to support the operations and expansion of Caltrain. The system risked closure this past spring with the vanishing of its regular ridership.

↑ Back to Top

OPEN SPACE

Will voters overrule City Hall on parks’ budgets?

We have come to rely on parks as never before – for respite, celebration, protest, and emergency response. Simultaneously, as is usual in fiscal crises, parks systems’ budgets have been among the first and most deeply cut. Efforts to restore or increase parks’ budgets include bond measures to acquire land for future parks and build dreamt-of parks. More exciting (if less sexy) are the 10 or so initiatives that will increase funds for the maintenance functions that ensure parks deliver on their promise. (Thanks to the Trust for Public Land’s (TPL) excellent ballot tracker from which we were made aware of many of these measures.) We’re particularly interested in the results of three referenda, which seek to create sources of operating revenue that will make parks more equitable and inclusive, including by reducing user fees, strengthening programs for families, and focusing on career tracks. – HR&A Vice Chairman Candace Damon

- In Rochester, MN, voters are considering whether to raise property taxes for the median homeowner by $33 in order to better maintain the parks system, including by “improv[ing] access to existing parks and recreational facilities for kids and people with disabilities.” The initiative is a product of TPL collaboration with the City’s Parks and Recreation Department.

- In Portland, OR, the City Council referred a five-year parks and recreation local property tax levy pricier than Rochester’s to the voters. With an annual increase of $151 for the median homeowner (same median home value as in Rochester), the proposed tax increase will restore budget cuts and “center equity and affordable access for all,” including by offering more free programs to low-income households. It has been advanced by Portlanders for Parks and endorsed by a diverse group that includes the Portland Business Alliance, Nike, and a host of groups focused on the concerns of local communities of color.

- In Collier County, FL, a second round of funding for Conservation Collier, a17-year old program to acquire and maintain land for conservation and recreation, is on the ballot. Proposed to be funded with a property tax levy that will increase taxes on the median home by about $35, 25-35% of funds raised will be dedicated to maintenance costs. Vincent Keeys, president of the local branch of the NAACP, stated, “As this pandemic, … environmental justice, and racial injustice ravage this nation, … we often look to Mother Nature for the cure.” Keeys, who grew up across from Fairmount Park in Philadelphia, noted the importance of reclaiming healthy green spaces for communities of color and low income and applauded Conservation Collier’s past success in equitable investment.

↑ Back to Top

EQUITABLE BUDGETING

Will voters approve new spending on equity?

Budgets are statements of priorities. We’re watching referenda that could unlock $4.7 billion to advance more equitable spending. Three cities – Baltimore, Dallas, and San Francisco – all have bond issuances on their ballots, while Los Angeles County’s referendum would set spending guidelines for existing revenues. All four initiatives would invest in community members who face neighborhood disinvestment and discrimination. As one example, $41 million of the Dallas Independent School District’s bond program would be earmarked for Student and Family Resource Centers for building racial equity, which HR&A and the Child Poverty Action Lab helped conceive. – HR&A President Jeff Hebert

- If Dallas voters approve the largest bond election in Texas history, they will invest $3.7 billion in new and renovated school facilities, $41 million of which for the aforementioned community resource centers with wraparound services.

- Los Angeles County voters could require that their government spend at least 10% of the general fund on community alternatives to incarceration. This would protect $400 million from being spent on law enforcement or jails, instead guiding it to housing, mental health programs, and social services that could keep people out of the criminal legal system.

- If two-thirds of San Franciscans sign on to Measure A, they will dedicate $239 million to open space, $207 million to mental health supports, and $41.5 million to improving public streets and plazas.

- A host of ballot measures for new borrowing in Baltimore could mean $72 million for public buildings and infrastructure, $38 million for school facilities, $38 million for community economic development, and $12 million for affordable housing.

↑ Back to Top

DIGITAL INCLUSION

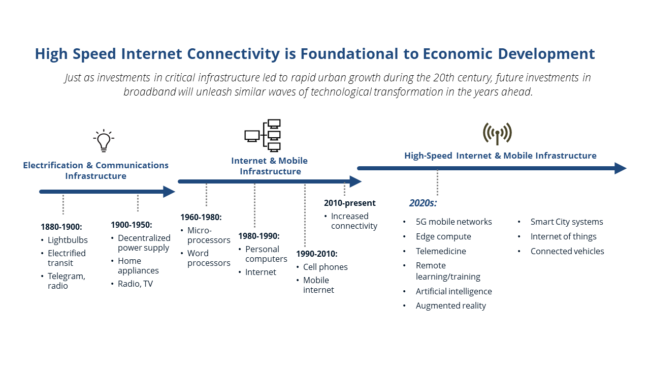

Will cities take charge of their broadband future?

In a year that has highlighted America’s digital divide, in which 18.4 million households lack broadband internet service, communities across the country are asking voters to help them connect all residents. Some are asking for new powers to override State limits on local sovereignty while others are asking to take matters into their own hands and invest millions of dollars to ensure internet access for all. With ISPs maintaining near monopolies in many cities, these attempts for greater local control are inevitable, and could unlock greater innovation at the local level. – HR&A Managing Partner Danny Fuchs

- The most ambitious effort belongs to Lucas, TX, where voters could approve more than $19 million in public bonds to create a city-run broadband utility that would offer subscription service to local households and businesses. The measure follows a feasibility study that recommended a 108-mile backbone fiber network to connect all residents and businesses within city limits.

- In Colorado, Denver, Englewood, and Berthoud could join a growing list of 120+ Colorado communities to opt out of a State law that prohibits local governments from providing broadband internet service. While the measures would not automatically establish municipal broadband, voter approval would permit the cities and towns to experiment with public options.

- As Chicago prepares to spend $50 million to expand broadband access to 100,000 residents, voters will weigh in on the question: should “all the city’s community areas have access to broadband Internet?” – a chance to justify bolder investment still.

↑ Back to Top

TAX RESPONSES TO CRISIS

In a year of crisis, will taxes provide relief?

As states and municipalities recover from a year of unprecedented public health and climate crises, ballot measures seeking to create new tax revenue have emerged as important sources to fund increased expenditures. Most of these initiatives levy new sales, utility, and/or parcel taxes. Many, however, go beyond flat-rate general fund tax increases to create more progressive tax structures that focus on high-value property sales and businesses with disproportionately high executive incomes. These tax increases would generate new revenue to ensure effective crisis response, including economic recovery and future disaster preparedness. – HR&A Partner Paul J. Silvern

- San Francisco residents will consider a host of tax-related measures: restructuring business taxes, doubling the real estate transfer tax for high-value properties, and taxing businesses whose ‘overpaid executives’ earn more than 100 times as much as their median employee in the city.

- In Los Angeles County, Culver City and Santa Monica are considering increases to property transfer taxes to fund a mix of local services. Culver City’s graduated rate would raise $6 million per year and Santa Monica’s flat rate would raise $3 million per year.

- Voters across California could modify property tax limitations introduced in 1978, requiring that commercial and industrial properties are reassessed to market value every three years, among other changes. These changes do not affect existing property tax limitations on residential or agricultural properties, however.

- Arizona’s increased income tax on individuals earning over $250,000 and couples earning over $500,000 would increase funding for public schools, especially teacher salaries. Illinois voters, meanwhile, could repeal their state’s flat income tax, allowing for the introduction of six graduated tax brackets.

- In wildfire-stricken California, Berkeley and San Diego County voters could authorize parcel taxes to fund fire protection.

- Oregon and Colorado voters could increase taxes on tobacco. Oregon would focus funding on healthcare programs. Colorado would turn the revenue toward health, housing, and education.

↑ Back to Top

ADDITIONAL MEASURES

Will systemic change win at the ballot box?

Ballot measures often come in waves, as the most urgent issues of the day inspire change and as citizen-led efforts in one jurisdiction spark action in another. More than two dozen local and State initiatives this year would reform policing and address mass incarceration. As the pandemic continues to batter the economy, worker safety nets are on the ballot. And the trend toward cannabis legalization could make its way to four additional states, with direct investment in restorative justice in at least two.

- Justice is on the ballot across the country, as numerous cities and counties, from Oakland to Philadelphia to King County, WA, are weighing reforms to police oversight, policies, and budgets in the wake of George Floyd’s murder at the hands of police in May. California is considering measures to restore voting rights for people on parole for felonies and to end cash bail, while Oklahoma would prevent prior non-violent felony convictions such as drug crimes from factoring into sentencing for people convicted of other non-violent felonies. The Vera Institute offers a deep dive into justice issues on the ballot.

- Workers could gain or lose rights as the pandemic continues to batter the service sector. In one of the country’s highest profile (and the costliest) referenda, California’s Prop 22 would reclassify drivers for Uber, Lyft, and other gig companies as independent contractors rather than employees, reversing a 2019 state law that extended labor protections to these workers. The gig companies argue workers benefit from the flexibility of independent work; Prop 22 proponents say only employee classification can protect workers’ interests. The voters will decide. Meanwhile, Colorado could become the first state to enact a paid leave policy by referendum, and both Florida and Portland, ME, could join the wave of jurisdictions establishing a $15 minimum wage.

- Four states could legalize marijuana this year. Arizona has the most progressive measure, with proceeds from a 16% sales tax distributed among community colleges, justice reinvestment, public safety, and infrastructure. Licenses would also favor people from communities impacted by marijuana laws. New Jersey would become the first state in the mid-Atlantic with legal cannabis. South Dakota and Montana round out the list.

↑ Back to Top