We sat down with one of HR&A’s most senior leaders to reflect on the progress he oversaw as HR&A’s CEO and what made him decide to shift his focus from HR&A’s corporate management back to the project work that inspired him to join the company almost 30 years ago.

While you’ve had a long history working in the transit and economic development sectors, much of your focus in recent years has been on managing HR&A as its third CEO. Can you share how the company evolved under your leadership and what led to your decision to transition into your current role as a Partner and Co-Chair of the Board?

For several years, HR&A Advisors has been in a time of exciting and meaningful transition. Over the last year, I have worked very closely with Candace Damon and Jeff Hébert, with our Board, and with Partners to plan and implement a transition that resulted in Jeff becoming HR&A’s fourth CEO.

Back in the early 2000’s, when we were a scrappy firm of 20 brilliant professionals in New York and L.A., I served as President and a near full-time Partner leading projects that included PlaNYC 2030, real estate advisory work for the Port Authority and NJ Transit, a re-use plan for the Walter Reed Army Medical Center in DC, and many more. As the firm grew, I focused an increasing amount of my time on the internal business. This included transitioning into an employee-owned company and me becoming HR&A’s third CEO in 2019. We also expanded our capabilities to help our clients tackle the pressing issues facing cities, resulting in the growth of our climate, urban tech, inclusive cities/equitable governance, infrastructure, housing, and broadband and digital equity practices.

HR&A today is truly a world-class firm that serves clients and communities around the globe with an outstanding impact across 550+ projects last year. We have also walked the walk that I shared with Partners in early 2020 shortly after becoming CEO — which was that we need to change our culture to attract and retain diverse and talented employees who are more representative of the communities we serve. And while there is still work to be done, we’ve made steady progress over the last four years due to the tremendous work of our company leadership and staff. As we shared in our recent 2023 ADEI Progress Report, our company is 47% BIPOC, and we were named a 2023 New York Urban League Champion for Recruitment, Retention, and Belonging.

While serving first as HR&A’s President and then CEO has been the greatest privilege of my professional life, in recent years, I’ve had less time available to work on the opportunities that originally attracted me to HR&A as a Senior Analyst in 1997. I’m ready to shift my focus back to the work and spend most of my time as an HR&A Partner, which I truly believe is the most attractive career choice for American urbanists.

In this “full circle” moment where you’re reconnecting with the project work that initially drew you to HR&A, what key themes continue to motivate you about transportation and economic development?

I think way back to when I was studying public policy in college, and I remember learning about the ways in which transportation infrastructure can positively and negatively impact people’s lives. I wanted to explore alternative models to traditional approaches to development, which have caused great harm to communities across the country, and that really launched a core theme of the work I’ve done throughout my career — with New York’s MTA, as Head of Business Planning for Transport for London (TfL), and of course with clients at HR&A.

While we’re in a time where there’s great appetite to do this work in new ways that can start to right past wrongs, I also know from experience that transportation infrastructure development takes time. In the eighties and nineties, I was looking at the anticipated economic impact of new rail transit systems like Washington’s WMATA, Atlanta’s MARTA, and Portland’s TriMET. Now 30 years later, those cities’ investments are coming to fruition, and you can see how the location of stations and the urban design around them has had a direct effect on where housing, offices, and amenities are located.

One of the projects that I worked on when I was at the New York MTA in the early Aughts was a multiagency planning effort called Access to the Regions Core, and a project that came out of that effort is what’s now called Grand Central Madison, which connects the Long Island Railroad to Grand Central. Grand Central Madison opened in early 2023—almost 20 years after I worked on the first stages! So, I want to be engaged in the next generation of transit infrastructure development now, so I can see these projects come life over the next few decades.

What do you think are the most exciting things happening in transit-oriented development, sustainable mobility, and economic development?

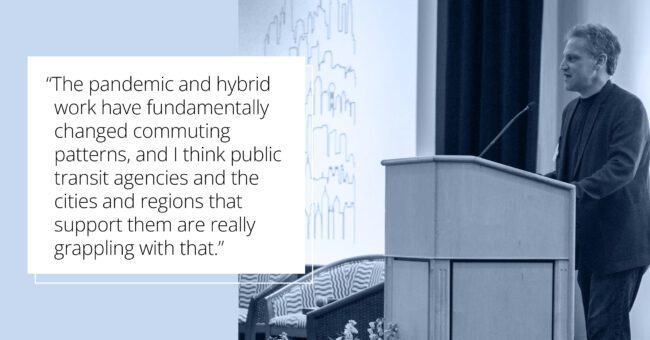

The pandemic and hybrid work have fundamentally changed commuting patterns, and I think public transit agencies and the cities and regions that support them are really grappling with that. Transit agencies have always been a subsidized model, but they were able to rely on fare revenue from commuters. In the post-COVID environment, we’re still far from a place where everybody is working five days a week in central cities, and most transit agencies are seeing ridership levels hovering somewhere around 70 – 90% of where they were before COVID.

That means the funding structures for transit have been disrupted. With that disruption, a lot of the work that we do at HR&A around transit-oriented development is becoming a more important piece of the puzzle than ever before. We’re helping transit agencies identify their surplus properties and understand what community assets could be built there — whether it’s housing, offices, retail, or even flex industrial spaces. These developments might help generate revenue and attract more riders to fill in funding gaps.

I’ve worked with some clients to evaluate the business case for making public transit services a free essential service, like fire stations or public schools. The climate implications are important to consider with this analysis, since mass transit is more environmentally friendly than single passenger gasoline powered cars.

We’ve talked a lot about the public sector, but how are developers navigating transit-oriented development in the post-pandemic world?

Developers are always looking to reduce risk, and one of the biggest risks they face in transit-oriented development is the time it takes to get something built. It’s important to minimize the red tape that slow things down. Having worked with both sides of public-private partnerships, we understand how to streamline the process, which is in the best interest of all involved. For example, when we work with transit agencies, we help establish ground rules for what kinds of uses they’ll accept for their development plans so developers know what’s possible. It’s also important for transit agencies to partner with their local cities to resolve issues about allowable density and design requirements.

When it comes to transit-oriented development in the post-pandemic world, one theme that’s really dominating the conversation with my developer clients is the housing crisis. HR&A has helped to identify a whole series of affordable housing strategies and solutions that can work for cities and regions overall, and we incorporate that thinking into transit-oriented development.

When thinking about diving back into this work, what gets you up in the morning, and what keeps you up at night?

I think what gets me up in the morning is the same thing that keeps me up at night: Climate change.

As the effects of climate change continue to collide with the inequities in our cities that were exacerbated by the pandemic, sustainable transit infrastructure is a critical piece of the puzzle. I’ve lived in metropolitan areas my entire life, so this work is not just my professional passion — it’s personal. I want to do my part to build vibrant, economically thriving, and healthy cities that will shape and support the lives of my children, my community, and the planet. I draw inspiration from one of the teachings of my faith, “If not now, when?” – and more than ever “now” feels like a critical time to apply the knowledge I’ve gained over the course of my career to help make it happen.