Minimum standards for JPA-sponsored, California Middle Income Housing Conversion Transactions

The housing supply crisis in California is being addressed through a wide range of critical yet complex public and private investments. But very few resources support new housing for middle-income households.

In the last two years, three California Joint Powers Authorities (“JPA”) and their developer partners, with approval from local governments, have originated more than $5 billion of tax-exempt bonds paired with property tax exemptions to finance acquisition of 9,000 apartments, which will be converted into affordable rentals for middle-income households. The total financing exceeds the current $3.7 billion annual allocations of Low-Income Housing Tax Credits for low- and very low-income households in California.

Our work with local governments across the state has been focused on ensuring that these investments maximize public benefits and meet local policy objectives. Our project evaluations help guide negotiations for this new type of transaction and illuminate the issues that local governments in California should consider before approving participation in these transactions.

A white paper, co-authored with the California Housing Partnership and CSG Advisors, guides our analysis approach and highlights the urgent need for local governments to carefully weigh the merits of middle-income housing JPA bond transaction proposals. As a result of this work, Assembly Member Ward proposed AB 1850 to establish minimum standards for JPA-sponsored middle-income conversion transactions.

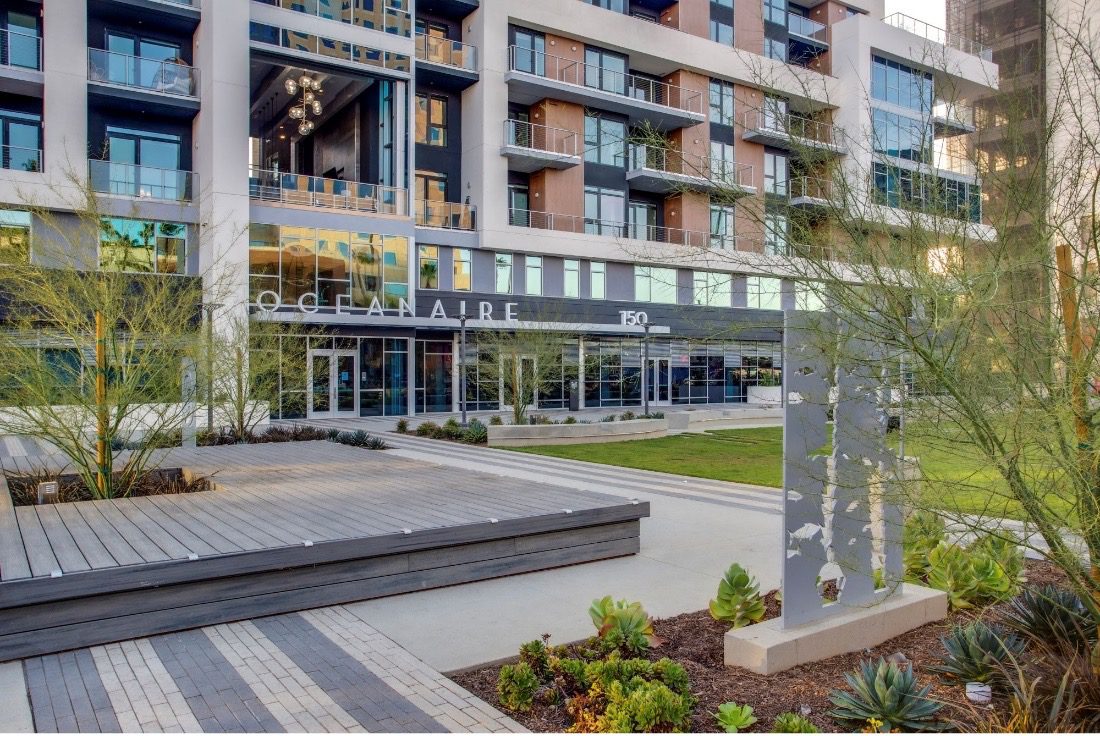

Project evaluation examples include two for City of Long Beach, where we helped negotiate better terms for a 215-unit building conversion, the Oceanaire and new construction of a 580 units, the Midblock Civic Center.

Image courtesy of Oceanaire